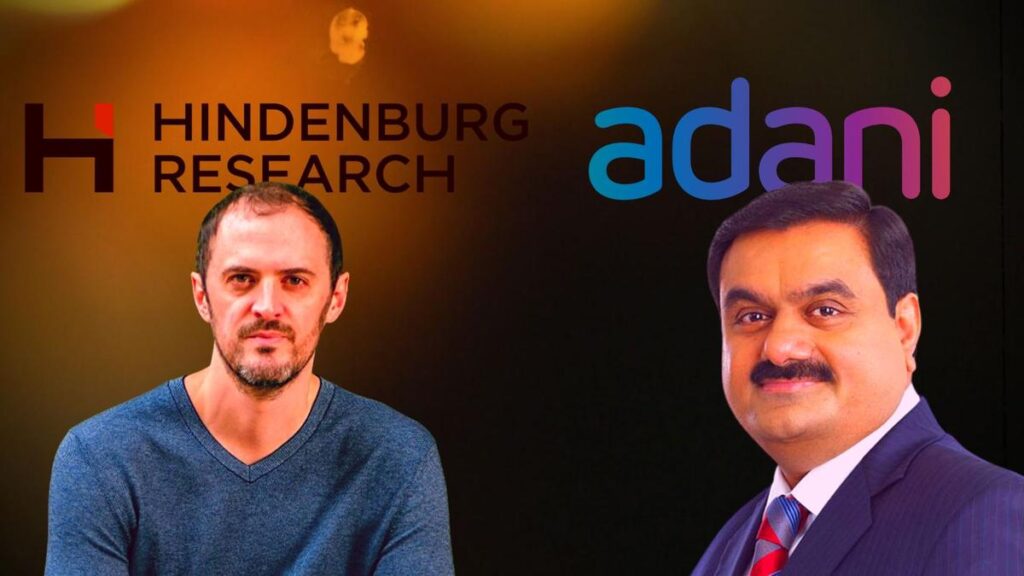

Controversy between the Hindenburg Research and Adani Group : 4 Disturbing Truths

The controversy between the Hindenburg Research and Adani Group revolves around a report published by Hindenburg Research, an investment research firm, that accused the Adani Group of fraudulent accounting practices and environmental violations. The report alleged that Adani Group inflated the value of its assets, misused funds from its subsidiaries, and engaged in bribery to facilitate its business operations.

The Adani Group has denied the allegations and called the report “malicious and misleading.” It has also initiated legal action against Hindenburg Research and its associates, claiming that the report was aimed at damaging its reputation and causing financial harm.

The controversy has sparked a wider debate about corporate governance and accountability in India, with some analysts suggesting that the case highlights the need for greater transparency and regulatory oversight in the country’s corporate sector. The dispute also underscores the growing scrutiny that multinational corporations are facing from investors, regulators, and civil society groups over their environmental and social impact.

Adani Group

The Adani Group is a diversified conglomerate with business interests across several sectors. Here is a brief summary of Adani Group’s business sectors:

- Energy: The Adani Group has a strong presence in the energy sector and operates several coal-based power plants in India. It also has a growing renewable energy portfolio, with investments in solar, wind, and hydro power.

- Ports & Logistics: Adani Ports and Special Economic Zone Limited is India’s largest private port operator, with a network of 12 ports and terminals across the country. The company also operates logistics and transport businesses that support its port operations.

- Agribusiness: The Adani Group has recently ventured into the agribusiness sector and operates India’s largest edible oil refining and packaging facility. It also has interests in the edible oil, pulses, and grains markets.

- Mining: The Adani Group has significant investments in the mining sector, including coal mining in Australia and India.

- Aerospace & Defence: The Adani Group has a growing presence in the aerospace and defence sector, with investments in aircraft manufacturing, defence equipment, and aviation infrastructure.

- Real Estate: Adani Realty is the real estate arm of the Adani Group and is involved in the development of residential, commercial, and retail properties.

- Financial Services: The Adani Group also has a financial services arm that offers a range of services, including wealth management, insurance, and capital markets.

Overall, the Adani Group is one of India’s largest and most diversified business conglomerates, with a presence in multiple sectors and a growing global footprint.

Hindenburg Research

Hindenburg Research is an investment research firm that specializes in identifying potential fraud and malfeasance in publicly traded companies. The company focuses on short selling, a strategy that involves betting against a company’s stock price in the hope that it will decline.

Hindenburg Research is not involved in any particular business sector and instead conducts research and analysis across a wide range of industries. The company has gained notoriety for its reports on companies in the technology, healthcare, and financial services sectors, among others.

Hindenburg Research’s reports typically highlight issues such as accounting irregularities, undisclosed related-party transactions, regulatory violations, and environmental, social, and governance (ESG) concerns. The company has a reputation for thorough investigative work and has been credited with uncovering several high-profile cases of corporate fraud and misconduct.

Overall, Hindenburg Research is a niche player in the financial services industry, with a focus on identifying potential short-selling opportunities by uncovering irregularities in the companies it analyzes.

Misleading Report Causing Controversy between the Hindenburg Research and Adani Group

The Hindenburg Research publication on Adani Group has raised questions about the accuracy and intention of the report. Some critics have argued that the report is based on incomplete or misleading information and that Hindenburg may have a financial interest in shorting Adani Group’s stock.

Hindenburg Research’s report on the Adani Group raises questions about its credibility and intentions because it has not reported on other companies, such as Microsoft, Infosys, Google, and others, that have been accused of funding riots or promoting public outrage as per the analysis given by the youtuber on its channel called String.

Click here to Watch the full video now

In the video it shows how there could be a possibility that big companies may be involved in the funding and publishing of Hindenburg’s Research on Adani to put a dent on Adani Group and damage the reputation of Adani Group.

Reason for Share Price Rise and Fall

The stock price of a company depends on the supply and demand of its shares in the market. When there is more demand for a stock than supply, the price of the stock will rise, and when there is more supply than demand, the price of the stock will fall.

The price of a stock is determined by the market, which is made up of buyers and sellers. When there are more buyers than sellers, the demand for the stock increases, which drives up the price of the stock. Conversely, when there are more sellers than buyers, the supply of the stock increases, which drives down the price of the stock.

The buying and selling of stocks by investors is influenced by a variety of factors, including company performance, macroeconomic trends, and investor sentiment. For example, if a company announces strong earnings results, investors may become more interested in buying the company’s shares, which would increase the demand for the stock and drive up the price. On the other hand, if a company announces poor earnings results, investors may become more interested in selling the company’s shares, which would increase the supply of the stock and drive down the price.

Overall, the stock price of a company is determined by the market forces of supply and demand, which are influenced by a variety of factors, including investor sentiment, company performance, and macroeconomic trends.

Conclusion

Hindenburg Research is a company only run by few people which is suspicious and on its website, there is no information about its investors, partners which raises more questions on the credibility and intentions on the company on publishing financial reports on such companies and impacting their stock price which also indicates that they are benefiting from short selling of shares directly or indirectly.

In today’s world technology is so advanced and information are available for free and easily accessible to all of us. Therefore, before panicking or pointing a finger by getting influenced a company which complete information is itself not in public is not a good idea. Do your research and analyze all the aspects to connect the dots.